Survival of public pension system depends on work, not workers

19/10/2016

A study by the Centre for Demographic Studies of the Universitat Autònoma de Barcelona (UAB) published today by the journal "Perspectives Demogràfiques" sets the debate on pensions on something additional to the ageing population and reveals the disuse of the demographic potential existing today in Spain, caused by the economic recession. This issue was debated on 20 October at a seminar organised by the CED-UAB, where researcher Pau Miret presented the study, entitled "La fallida en el sistema públic de pensions: no en nom de la demografia!” (The Bankruptcy of the Public Pensions Sytem: not in the name of demography!).

There is no lack of workers, only lack of work

The study explains that the majority of people registered for Social Security are aged 38 to 59 years old: they are the "baby-boomers", born in the 1960s and 1970s. The oldest workers will retire in eight years and the youngest have 30 years of productivity ahead of them. This is not an ageing population at all. But only 70% of this immense active population currently works and contributes to social security funds: the remaining percentage is either unemployed or works in the informal sector, while a small percentage is made up of civil servants working for the central administration bodies.

"We do not need workers, we need work", explains CED-UAB researcher and author of the paper Pau Miret, who goes on to highlight that "it is not demography's fault, it is the economic crisis". "Hearing the well-known argument that the ageing population will make paying pensions impossible, since there are not enough people able to pay the growing number of pensions, it is easier not to realise that Spain currently is in very good health demographically", Pau Miret states.

The "baby-boomers", the largest generation in Spain, should now be the great upholders of the system. They are within the central working ages (38 to 59 years old), in which most of them hold a good position and therefore are at their full productive and contributive capacities, with a couple of decades of work years ahead of them.

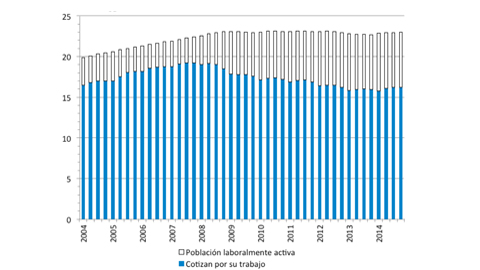

Although there has never been a larger workforce, the economic recession has left a good part of this workforce out of the formal sector. The active workforce reached 23 million people in 2008 and since then has stabilised, while the number of taxpayers has fallen since the crisis and reached under 16 million. It is estimated that at least 18% of the demographic potential is not being put to good use. There are four million people who could be paying taxes and are not doing so.

Tensions in the public pension system

The population receiving a retirement pension has grown 23% from 2004 to 2014, going from 4.5 to 5.6 million people. The demographic dependence relation between taxpayers and pensions at the end of the economic expansion period was 1 to 4. Although the situation has worsened since 2014, it is not drastic and now every 3 taxpayers pay for one pension.

The panorama worsens when other collectives perceiving pensions are added (invalidity, widowhood, orphanhood, etc.). In 2014 this ratio was 0.6: higher than 1 pensioner for every two net taxpayers.

However, the tension becomes unbearable when the retired population is combined with those receiving unemployment benefits. The demographic dependence relation in Social Security is then 0.8: 4 persons receiving pensions or benefits for every five net taxpayers.

"The tensions in the contributive system of the Social Security is and will, in the following decades, not be caused strictly by demographic reasons, but by a recessive phase of the capitalist economic cycle", UAB researcher Pau Miret points out.

This tension would relax if all the demographic potential were put to use. Incorporating all of the workforce into the formal labour market would mean more taxpayers and less people receiving unemployment benefits. In addition, if occupational health were improved in a way as to make invalidity pensions a mere anecdote, the dependence relation would fall to less than half of what it is now.

On 20 October the seminar "Ajudar i rebre ajuda: mercat laboral i seguretat social" (Helping and Receive Help: the labour market and social security) took place at the UAB. The seminar is part of a R&D&i project in which several experts discussed these issues. Researcher Pau Miret offered a conference entitled "El paraigua de la Seguretat Social: qui el sosté i qui es protegeix” (The Social Security Umbrella: who holds it and who is protected?). Following that was the presentation of the study published on 19 October in Perspectives Demogràfiques which focused on pensions and demography in Spain.